- Home

- Know Us

- Our Services

- Products

- Non Life Insurance

- Loans

Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

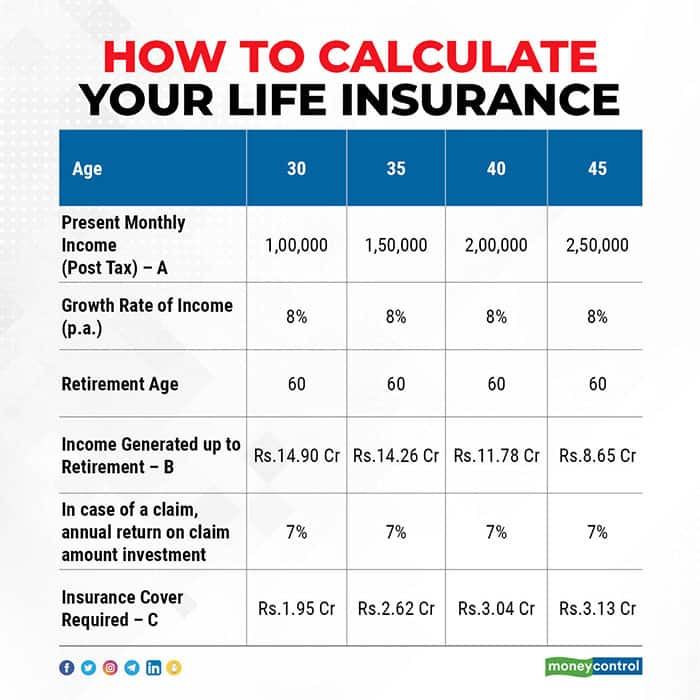

The income replacement method helps arrive at the insurance amount based on current age, retirement age, income, and expected growth in income every year.

COVID-19 and its brutal after-effects have wreaked havoc in many lives. But the one good aspect to come out of the pandemic is the realization that insurance is a must-have product for all of us.

It was natural on our part to have avoided thinking about any unfortunate event that could affect us or our families. We are all wired to think positively, but the essence of insurance is to protect us from the risk of financial loss.

Life insurance ensures that your family continues to get financial support in the unfortunate event of your absence. It is your income that helps the family members to not just take care of regular expenses, but also to invest and accumulate for financial goals. Everything can get disturbed financially in case of a lack of life insurance cover.

Calculating insurance needs

There are different thumb rules to calculate your life insurance coverage requirements. Often, it is stated as a multiple of your annual income. However, the income replacement method is one of the best ways to arrive at the insurance amount based on current age, retirement age, income, and expected growth in income every year.

You can follow these steps to evaluate how much insurance cover you need.

Step #1: Calculate how much you contribute to your family’s monthly household income by deducting your personal expenses from your take-home salary.

Step #2: Calculate the total income you will get for your family up to your retirement age, by factoring in annual increments as well.

Step #3: Find the present value of the total income you are expecting to generate up to your retirement (in step #2), if this total income is invested in low-risk options for the family to withdraw every month or year.

Any outstanding loan amount gets added to the insurance cover is the responsibility of repaying the liability gets passed on to family members in the absence or inability of the breadwinner. The existing insurance cover and savings/investments are deducted from the above amount to come up with the total insurance cover needed.

Why term plans work best

An ideal way to ensure your life is to go for term insurance and not for any other plan such as endowment or money-back policies, as the purpose of buying insurance is to protect yourself and not to make an investment. Since term plans do not pay any money back if remain alive at the end of the policy tenure, the premiums are also the least.

Along with covering life, one can also look at a personal accident cover – it does not cost much – if your job involves traveling. The critical illness rider is another useful option that covers the risk of health and finance getting disturbed because of major life-threatening illnesses. It provides immediate payment to the insured person on the diagnosis of approximately 35-55 illnesses depending on the policy of the company. Along with that, the life insurance cover continues and future premiums are waived in case of critical illness.

Insurance acts as a strong wall built around the fortress to ensure that you and your family do not face a financial crisis in case of any unfortunate event. The cost of being under-insured or not having insurance is quite high. Hence, it may not be a bad idea to recheck your life insurance cover as it is an integral part of your personal finance.

Copyright © 2024 Design and developed by Fintso. All Rights Reserved